Tax deferred annuity calculator

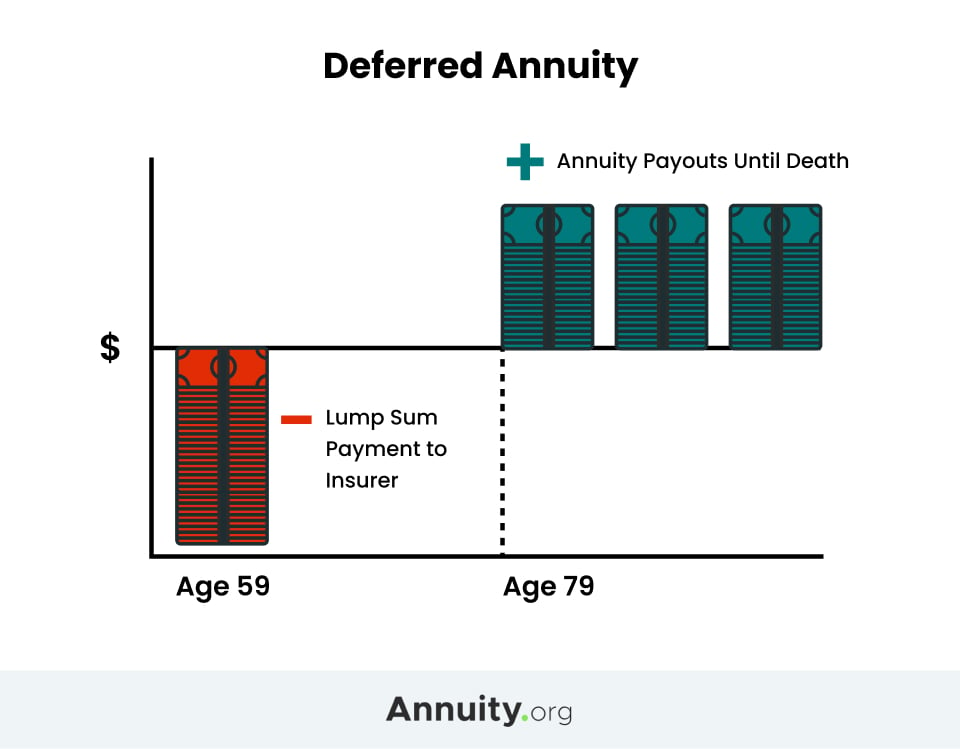

The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. In essence when you buy a deferred annuity you pay a premium to the insurance company.

The Best Annuity Calculator 17 Retirement Planning Tools

Unlike most variable annuities an indexed annuity sets limits on your potential gains.

. The advantages of a tax-deferred annuity. Applicable Tax Rate for Super Senior Citizen 80 years or above Up to 3 Lakh. Furthermore this tool does not ensure the availability of or your eligibility for any specific product.

It is always a good idea to consult your tax legal and financial advisors regarding your specific situation. With a Roth IRA you contribute after-tax dollars to your account up to the annual limit. A non-qualified annuity on the other hand is funded using after-tax dollars.

Assets in a tax-qualified retirement plan already enjoy tax deferral. Possible exceptions for annuity surrender charges include death benefits nursing home admission and terminal. An immediate annuity converts a lump sum into cash flows from day one.

Annuity payment options depend on the type of annuity purchased. Our income tax calculator calculates your federal state and local taxes based on several key inputs. It is used by insurance companies to assess the quantum of money to be paid either as a regular income or a lump sum.

Your household income location filing status and number of personal exemptions. A 1035 Exchange taken from the Internal Revenue Code section of the same number is an IRS provision in the tax code that allows policyholders to transfer funds from a life insurance plan endowment or annuity to. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the.

Surrendering your annuity will trigger the income tax that has been deferred up until that point. Long-term care annuities are a tax-deferred annuity with a rider that sets up payments for long-term care if you need it in the future. Zakat payment only if not deducted through MTD already.

With our income tax calculator you can roughly estimate how much tax savings you will be able to make when you file for your tax in 2019. 2022 Immediate Annuity Rates Immediate Annuity Income Quote Calculator Whats an Immediate Annuity SPIA DIA QLAC. When you are shopping for immediate annuity rates or immediate annuity quotes it is good to understand that this is the most fundamental pure form of an annuitySingle Premium Immediate Annuities acronym SPIA date back a couple of.

Theres still time for you to carefully plan your. It is used to defer the tax on earnings. At the same time a deferred annuity limits your ability to repurpose your retirement savings and can be difficult to reverse if you change your mind.

Life annuities with period certain annuities pay a lifetime income for a set period of years. Immediate annuities can payout within a year of purchase. Division O section 111 of PL.

The amount of taxation varies depending on whether you purchased an annuity with pre-tax dollars or not. Annuity calculator - Calculate the annuity value of different types of annuities such as immediate annuity deferred annuity fixed annuity etc. That kind of sounds like a Roth account but theres a catch.

However any growth or earnings on. It is used by investors to add to their existing retirement income such as Social Security. As is the case for most annuities a tax-deferred annuity can provide income for the remainder of an individuals life life.

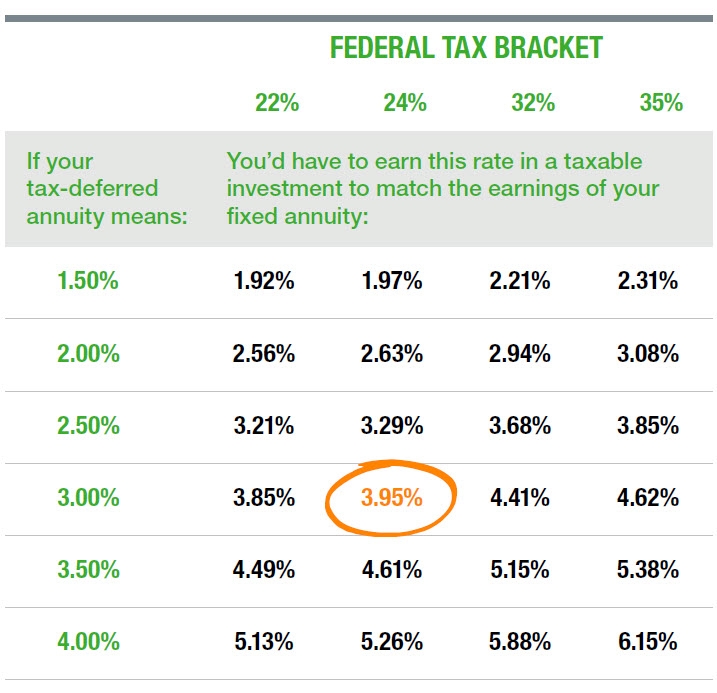

However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. Roth IRAs and Roth 401ks. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. However what youre describing was NOT money originating in a tax deferred account eg an IRA 401k or non-qualified ANNUITY but simply an account with after-tax savings that is being used to buy a period certain annuity. Deferred annuity Interest on housing loan subject to meeting stipulated conditions and.

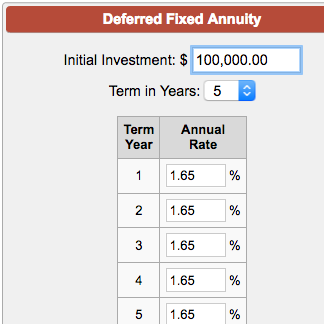

Annuities are taxed at the time of withdrawal regardless of the type of annuity purchased. The contributions made to a non-qualified annuity arent taxable. Compare the 3- 5- and 10-year Fixed Guaranteed Growth Annuities.

A deferred annuity is an insurance contract that generates income for retirement. Once the annuitization or distribution phase begins again based on the terms of your. A Roth IRA isnt an investment itself but a retirement account for tax-free investing.

By following annuity rules earnings will accumulate on a tax-deferred basis until withdrawals are ready to be made. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. If you die before the period is up the payments continue to your spouse or other beneficiary for the set period of.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract. Therefore a tax deferred annuity or fixed deferred annuity.

In addition to being protected against it promises a minimum monthly payment. Deferred annuities take years to payout as the tax-free annuity grows with interest. 01 Flexibility for the future.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. For 2021 the limit is 6000 plus an additional 1000 catch-up contribution if youre 50 or older. Regardless if its a fied or variable your princiapl is protected.

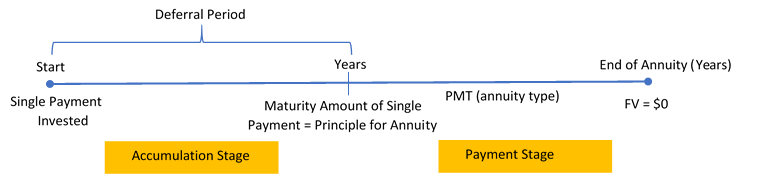

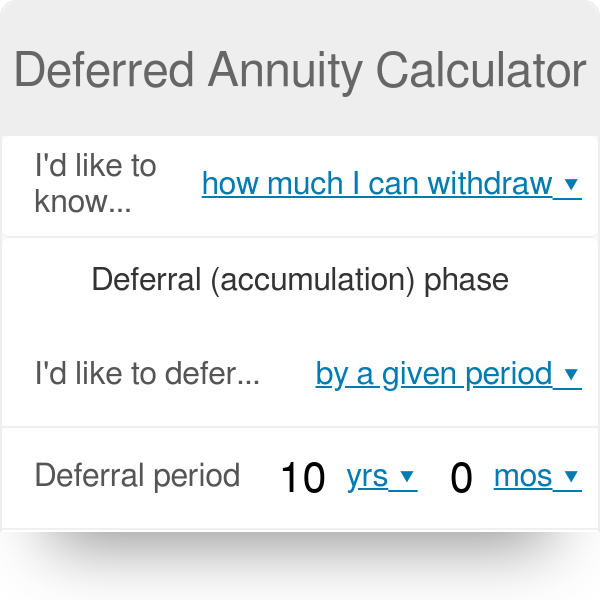

Should your financial needs change you can. The above calculator provides for interest calculation as per Income-tax Act. A deferred annuity has an accumulation phase followed by a disbursement annuitization phase.

Funds accrue on a tax. Payout schedules determine the duration of. Deferred Annuity Calculator See note 1.

No 10 tax-penalty applies. Earnings in annuities grow and compound tax-deferred which means that the payment of taxes is reserved for a future time. In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental.

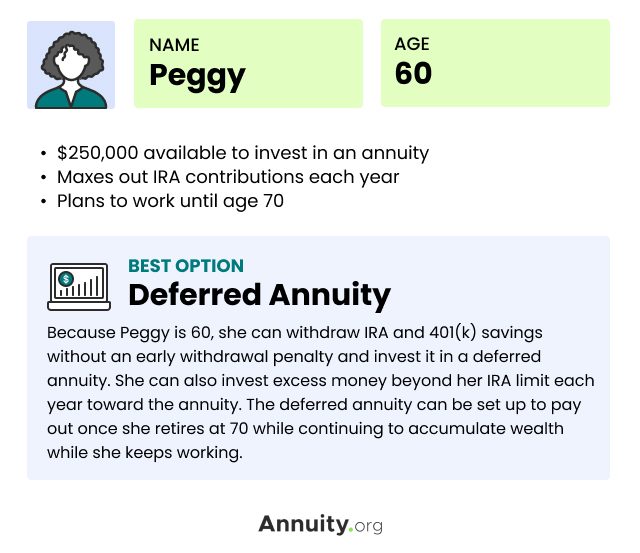

A deferred annuity allows you to continue working while money accumulates in the annuity providing a guaranteed lifetime income stream when you finally retire. You can read more about annuity taxation here. An index annuity is an annuity whose rate of return is based on a stock market index such as the SP 500.

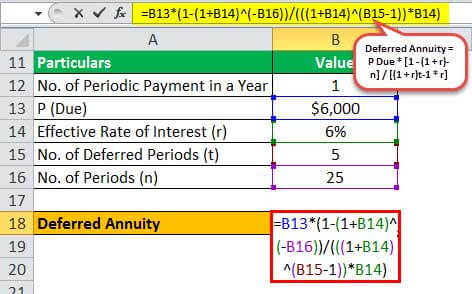

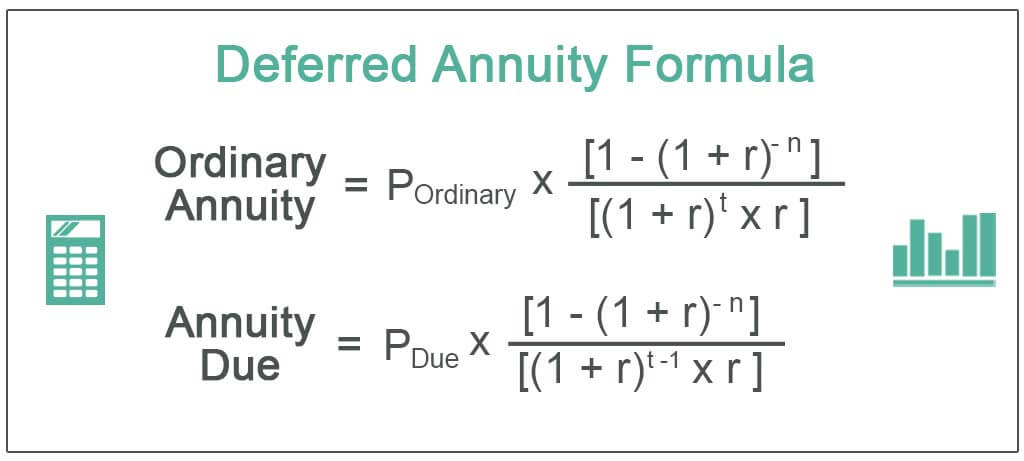

Deferred Annuity Formula. A surrender charge is a fee charged by insurance companies that you must pay if you sell or withdraw money from an annuity early. Some of the major uses of deferred annuity formula are as follows.

Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

Deferred Fixed Annuity Calculator

Life Insurance Vs Annuity How To Choose What S Right For You

Deferred Annuity Calculator

Aaa Deferred Annuity

Deferred Annuity Formula Calculator Example With Excel Template Annuity Formula Accounting And Finance Resume Writing

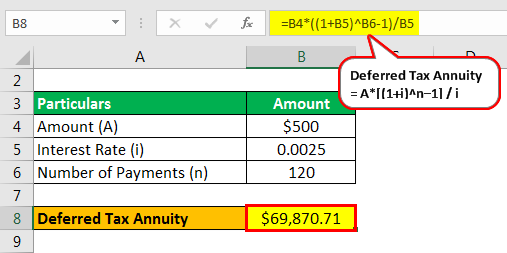

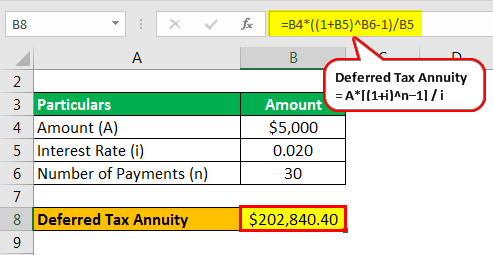

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Deferred Annuity Definition Formula Examples With Calculations

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

12 1 Deferred Annuities Business Math A Step By Step Handbook Abridged

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Tax Deferred Annuity Definition Formula Examples With Calculations

Show Clients The Benefits Of Tax Deferral The Standard

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

Deferred Annuity Calculator